The housing market has been overheated during the pandemic. Between strong household finances and demographics, demand has outstripped supply. The result is both for rent vacancies and for sale inventories are low. Rents and home prices have increased considerably.

The mortgage rate shock so far this year is changing the housing market dynamics. 30 year mortgage rates have risen from around 3% at the end of 2021 to just over 6% in recent days. When combined with ongoing price appreciation, this means the cost of a mortgage payment has increased 40-50% in just a handful of months.

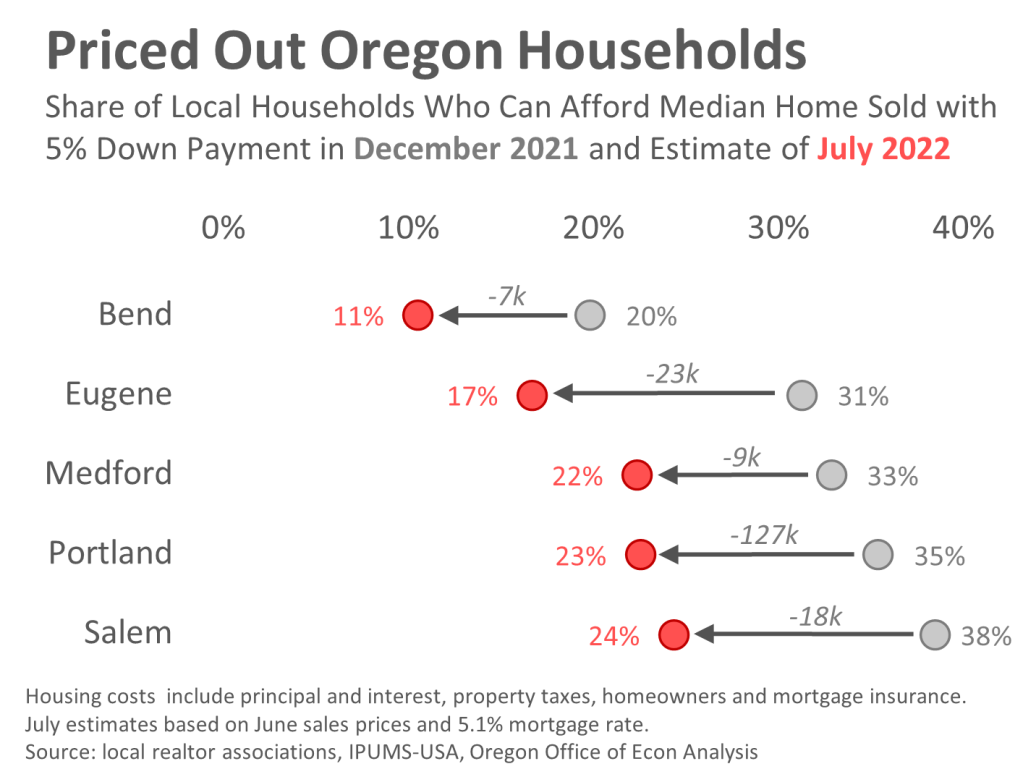

The impact here is that the potential pool of homebuyers for the median priced home has been effectively cut in half as seen in the latest edition of the Graph of the Week. It used to be that more than 1 in 3 households in the Portland region could afford to buy the median home but that has fallen to less than 1 in 5 at today’s prices and interest rates. Our office estimates that 168,000 Portland area households have can no longer afford the typical home sold based on these changes. In the Bend metro area only about 1 in 10 households can afford to buy the median home sold today, a reduction of 9,000 households compared to just a few months ago.

Update 8/4/2022: Mortgage rates have fallen down to around 5% in recent days. The following chart updates the analysis based on the latest sales price data available and a 5.1% mortgage rate. Overall this is a relative improvement in affordability in the past month or so, but still a large change from the beginning of the year.

There are a lot of implications from this erosion in ownership affordability.

First it means less demand to buy homes today. Or at least fewer qualified buyers. Fed Chair Powell said the housing market needed a reset. Our office’s baseline outlook is for sales to drop in the months ahead. Price appreciation will slow considerably. Housing starts are likely to decline in the back half of the year. (Nationally, builders are seeing more cancellations and having to bring back incentives and price reductions.) That forecast was developed 6-8 weeks ago and mortgage rates have risen even further since, meaning that these market changes could end up being more pronounced than anticipated. We shall see how financial markets evolve in the coming weeks.

Second, for sale inventories will increase. In Portland, active residential listings are up 19% when looking at May 2021 to May 2022, however May 2022 was still the second lowest May on record. Inventories are still about half of what they were in the years leading up to the pandemic. So even, as inventories rise and there are more buying opportunities, there may be more price pressure than you might think looking at interest rates alone. We are just moving away from such an extreme seller’s market to something that’s at least a bit more balanced. Ultimately how far the pendulum swings is still to be determined. These changes usually take time to develop and with inventories coming off of record lows there is a long way to go.

Third, we know these affordability changes impact credit-sensitive buyers much more. This includes younger households and first-time homebuyers who need to finance their home purchase. Investors and long-time homeowners who have a lot of equity are less affected as they do not necessarily need to fully finance a purchase. See our office’s recent Twitter thread for more charts on these generational/demographic impacts.

Fourth, this means increased demand for rentals and ongoing rent increases as potential buyers are priced out. Whether these rental price increases ultimately result in reversing the increase in household formation during the pandemic is still unknown. It is also possible that the rental stock will increase as some builders who cannot find individual buyers will turn toward the Build For Rent market to offload properties.

Finally, there are a few things we don’t know or haven’t seen yet in the data. Just how strong are finances for middle- and upper-income households? Are they able to weather these higher costs more easily than you might think? How quickly will seller expectations and the market rebalance to this new reality?

Portland area home sales are down just a little bit in April and May on a seasonally adjusted basis. But we have yet to really see the impacts of the higher rates in the data. This is generally true across some other West Coast markets. Given these markets are underbuilt overall, it could be that they are a bit less sensitive to these changes than some inland markets. Even so, Oregon is not immune to these changes and overall dynamics. Data in the coming months should show the impacts.

Bottom Line: Our office’s long-standing concern is our lack of housing production. Worse affordability impacts Oregon household’s every day, and could slow future economic growth due to fewer people being able to move here and increase displacement risks. While the recent run-up in mortgage rates is problematic for those looking to buy or sell a home this year, it is likely to be more of a temporary adjustment period in the big picture. Longer-term we know housing demand will be solid given income growth and demographics. Oregon needs to see continued gains in new construction.

Bonus Graph of the Week. I tried. I promise you I really tried to keep this to just one chart but after I put this together I couldn’t keep it out because it tells an important part of the story. As Altos Research’s Mike Simonsen says, one key metric to watch are price reductions. If price reductions are more common that’s indicative of lower effective demand at today’s prices, and that buyers are running into their invisible price ceiling as Zonda’s Ali Wolf calls it. Today there are more price reductions than there have been in years in the Portland market, but again, coming off these really low rates of the extreme seller’s market. Note how the price reductions are accelerating during the spring selling season this year, whereas they typically peak late summer or early fall for those who missed out selling during the peak season.

(Note that Zillow only has weekly data for the largest 100 metros so we do not have other Oregon data besides Portland to compare.)

Josh,

It is extremely misleading to treat “median” purchase price of a home as the graphic “bellweather” of a housing crisis!

Gues what? When I bought my first home at 30-years old, I couldn’t come close to “affording” to purchase a house at the median price (or even well below). But I was housed after moving to Eugene for 2 years by renting a room in an owner-occupied house and then buying an absolutely trashed rental in a really bad neighborhood. For forty years, I and others have worked to build careers, save money, fix up our houses and work for the safety and peaceful enjoyment of our older neighborhood.

Our neighborhood retains small, post-war houses, some with marginal maintenance, that provide an “in-ramp” to younger and less well-off households.

How many of the households estimated that cannot afford to purchase a median-priced dwelling end up unhoused? What is the distribution of these households’ income and the inventory of “affordable” rentals and for-purchase homes in corresponding Household Income categories?

That’s the useful, first-order analysis of any “housing crisis.”

The now outdated data in Eugene is clear. There’s a SURPLUS of affordable housing for all income categories above “Very Low Income” (50% of median income) households, and almost all of the households for which there is a deficit of “affodable housing” are “Extremely Low Income.”

How about providing that data?

By: Paul Conte on June 21, 2022

at 11:42 AM

Paul, good to hear from you again. I wrote about the distribution of available units versus the distribution of what households can afford a couple months ago. https://oregoneconomicanalysis.com/2022/02/15/construction-housing-supply-and-affordability/

By: Josh Lehner on June 22, 2022

at 12:29 PM

Piggy-backing on Paul’s comment, I had the same reaction. If someone is having difficulty affording something, whether it’s a pizza, a car or a home, they would be nuts to look at the median priced items. They naturally look at the less expensive items. My quick search of Zillow found 950 listing BELOW the median price, 200 of which are at or below $300,000, which is 46% lower than the median price. So those 170,000 families aren’t necessarily “priced out” of the market. They may just need to adjust to the lower end of the market. When I first purchased a home, the interest rate was 9% and we bought something we knew wasn’t a forever home but it was our pride and joy while we owned it.

By: Daniel Keeney on June 22, 2022

at 12:07 PM

Thanks Daniel. You are correct that these households who could buy in the middle price tier of the market are not truly priced out. I have updated the language in the third paragraph to mention this is just about the median home sold. Now, of course it is indicative of the overall impact. The whole distribution of affordability changes.

By: Josh Lehner on June 22, 2022

at 12:27 PM

Josh,

I hope folks will follow the lonk to your prior post and review my criticism of the conclusions. Experience continues to demonstrate that marke-based deregulation exacerbates the true “housing crisis.”

Re the current post, that chart in your prior post shows there’s a significant surplus of “affordable” housing for households who cn afford $500/month or more rent.

The chart on this post is a) not at all relevant to a true “housing crisis,” and even as an indication of “unrealized housing desire” it’s not informative. To understand the relevance of the “median price”, you have to know the numbers of buyers and their income category. Here you make an invalid comparison between a median from sales data that is volatile month-to-month and (presumably) household income which is a) from a larger population, and b) may be temporarily high or low, based on Covid-19 factors.

Look, the real issue for State Government is not how the market is responding to demand, but rather that too many poor households have too little left over after monthly rent to pay for basic human needs. Let’s see some useful drill-down on the nature of those households, the categories of type and cost of housing they need, and potential solutions to developing the truly “needed housing.”

— Paul

By: Paul Conte on June 22, 2022

at 1:14 PM